MELBOURNE – October 8, 2021

Homely.com.au, Australia’s largest industry-backed online real estate marketplace, has integrated online home loan provider, Well Money, into its full service real estate search. The integration with Well Money includes a comprehensive, instant borrowing calculator that provides helpful data for home buyers to gauge the realistic cost of every property listed on Homely, without having to provide information about themselves upfront.

The calculator integration is part of a collaboration between Homely and Well Money. This partnership is designed to bridge the gap between browsing and enquiring online by offering easily-to-understand loan estimate breakdowns right from the get go, thereby making it easier for people to find their next home.

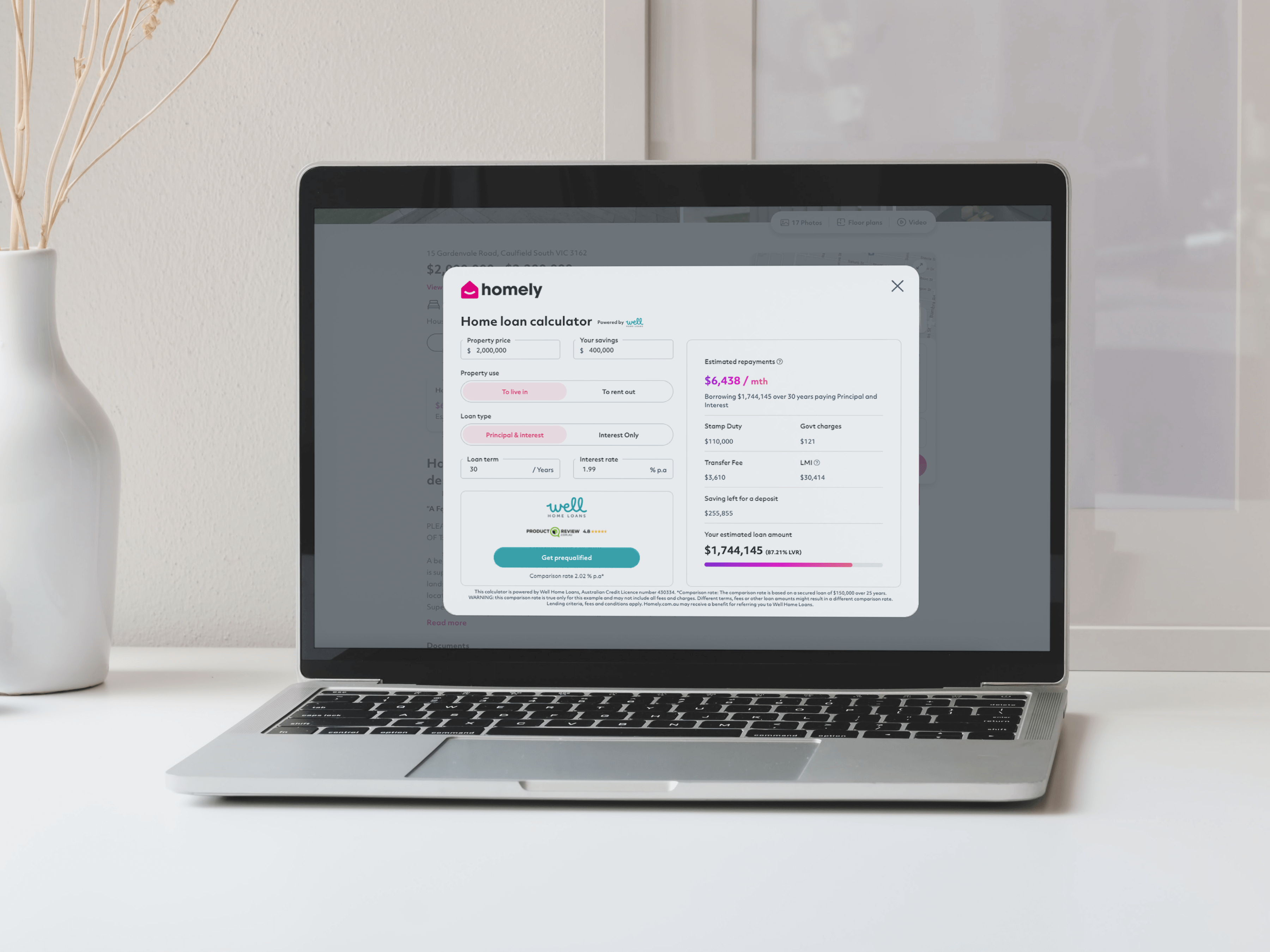

The Well Money Calculator shows property seekers how much they may need to save for a deposit, stamp duty, estimated monthly repayments, LVR, estimated total loan amount and even government taxes down to the dollar.

CEO of Well Money, Scott Spencer says, “We have built a reputation for offering some of Australia’s lowest interest rates, providing great service and being fully transparent with customers. Our goal has always been to take all the things people dislike about banks, and do the opposite.”

Scott continues, “Well has a reputation as being surprisingly easy to do business with, as well as a really smooth digital experience.”

This new integration, now a part of every ‘for sale’ listing on the Homely platform, is another way Homely speaks to its proposition of offering more than real estate. The easy-to-use widget is a helping hand in one of the most complicated and frustrating aspects of home buying for most Australians – understanding all the costs associated with buying their next home.

Scott adds, “One of the things that holds people back from entering the market is figuring out the costs involved. If you don’t know how much you need to save for a deposit, how much you need to budget for transaction costs and how much you need to pay in ongoing mortgage payments, it can feel too hard to take the next step. The beauty of this calculator is that it clears up a lot of that confusion, which allows people to make more informed decisions. Including additional costs like stamp duty and lender’s mortgage insurance (LMI) in our tools means people can feel more confident about where they stand when looking to buy. We see a lot of homebuyers surprised or not prepared because they didn’t know where to find the information – now they don’t have to go anywhere else to look for it.”

Homely’s Head of Product, Luke Kenyon says, “A good product helps consumers find what they are looking for all in one place. While Homely already offers an industry-leading and unique set of tools to help home buyers find the perfect place to live, we know that the financial element of buying a house is what gets a lot of people stuck on their journey. Being able to offer that information in a digestible, seamless, hassle-free way is exactly the kind of solution consumers need.”

Helping it all add up

Homely and Well Money hope to help home buyers, at all stages, looking to make a new move in the property market when it comes to making sense of what is available to them in the current market and how lending criteria might have changed since the last time they checked.

Homely’s Head of Industry, David Webb says, “This is a great tool if you’re a first-time buyer, or even if it’s just been a long time since you last bought.” He continues, “New approaches to lending have changed the borrowing landscape, so the more information you can get about where you stand financially, the more likely you’ll be to achieve your property goals.”

David explains, “It’s important to understand your financial position at every stage of the property journey. When you know what you can afford, you can make informed decisions about how you want to enter the market – property size, type and location.” He adds, “This information is especially important for when you do find a property that ticks the boxes – allowing you to make a winning offer or bid without risking finance falling over.”

Scott adds, “We made sure to include stamp duty calculations too, because stamp duty and lender’s mortgage insurance (LMI) can add thousands or even tens of thousands of dollars to the cost of buying a property. It’s important you understand the full range of costs involved in buying a property, so you know how much you can afford to borrow and what your maximum purchase price could be. Even people who are good with money or who have bought real estate before can find it hard to get their head around the numbers. This calculator makes it easy to work out what sort of deposit you need to save.”

The Well Money calculator is now integrated on all Homely’s for sale listings on Homely.com.au. Well Money is a digital-first, independent and 100% family-owned home loan company. Well has received multiple awards in the financial and home loan sector awards over the last two years, including; RateCity Gold Award 2021 Best Refinance Home Loan, Mozo Experts Choice 2021 Offset Home Loan and Finder Awards 2020 Winner of Owner Occupier Home Loan 3 yr fixed.

About Homely

Homely was founded in 2014 by brothers Jason and Adam Spencer in Melbourne, Australia. Since then, Homely has grown to become a large team of passionate developers, sales managers, account managers, marketers, designers and customer support people across Victoria, NSW, Queensland, WA and South Australia. Homely.com.au is unique in that the portal is not not only ad-free and uncluttered for an optimal experience. It also offers a proprietary suburb and street review service, designed to make it faster, easier and friendlier for buyers and their agents to find the perfect place to call home. A key feature of the platform allows agents themselves to not only list homes, but review streets and suburbs in their local areas. The Homely experience is so much more than buying and selling. It’s about connecting and empowering consumers with the knowledge they need about what life is like in areas they’re thinking about moving to. Homely partners with agents and the real estate industry to deliver an alternative and affordable industry-backed real estate portal. The Homely app is available for download on the App Store and Google Play. Learn more about Homely here.